In less than 10 min today, I’ll be showing you the best loan apps in Nigeria that will grant you access to quick personal cash loans without requesting collateral, and with no paperwork involved as you don’t even need to go to a bank, and the only tool you’ll need for this process is just your smartphone with a stable internet connection.

With these apps, you can get loan amounts as low as ₦5,000 to foot some domestic bills or as high as ₦20,000 – 100,000 and above may be to pay your tuition fees, house rent, invest in a business, etc.

And here’s the best part, no one will even know that you took a loan in the first place.

So, you’re ready?

Sure, then let’s get begin. #cheers.

More guides

- How to buy phones on loan or credit in Nigeria, & pay small-small monthly.

- The best & most-trusted apps to save & invest your money in Nigeria.

- How to get virtual dollar Visa & Mastercard to make online purchases in Nigeria.

10 best loan apps in Nigeria (2023)

The 10 best loan apps in Nigeria right now include;

- Carbon (Paylater)

- Fairmoney

- Branch

- QuickCheck

- Okash

- XCredit

- 9Credit

- PalmCredit

- Sokoloan

- Aella app

| Loan App | Range | Duration | Interest | Requirements |

|---|---|---|---|---|

| Carbon | ₦1,500 - 1,000,000 | 2 wks - 3 months | 1 - 21% | Biodata, education, work, bank details (incl. BVN) |

| FairMoney | ₦1,500 - 500,000 | 2 wks - 3 months | 10 - 28% | Biodata, education, work, bank details (incl. BVN) |

| Branch | ₦1,000 - 200,000 | 1 - 15 months | 14 - 28% | Biodata, education, work, bank details (incl. BVN) |

| QuickCheck | ₦1,500 - 500,000 | 15 - 91 days | 2 - 30% | Biodata, education, work, bank details (incl. BVN) |

| Okash | ₦3,000 - 500,000 | 15 - 91 days | 36.5 - 360% (Incl. processing fee) | Biodata, education, work, bank details (no BVN needed) |

| XCredit | ₦5,000 - 500,000 | 10 days - 5 months | 12 - 24% | Biodata, education, work, bank details (no BVN needed) |

| 9Credit | ₦3,000 - 100,000 | 6 days - 4 months | 74.2% (Incl. processing fee) | Biodata, education, work, bank details (no BVN needed) |

| Palm Credit | ₦5,000 - 300,000 | 7 - 180 days | 4 - 24% | Biodata, education, work, bank details |

| Sokoloan | ₦5,000 - 100,000 | 7 - 180 days | 4.5 - 34% | Biodata, education, work, bank details |

| Aella app | ₦1,500 - 1,000,000 | 7 - 180 days | 2 - 20% | Biodata, education, work, bank details |

1. Carbon(PayLater)

Download now: Carbon (PayLater) loan app.

I don’t want to exaggerate words here, but PayLater, or Carbon rather, is actually the best loan app that you can get your hands on right now in Nigeria.

All you need do is download the app from Google Play Store which you can do when you click the link above;

And after you’ve done that, you need to fill in your Biodata in a form that will be provided for you, and after you’ve filled and submitted all the necessary info including your bank details as well, a loan amount will be calculated for you based on the information you provided, and after that, a loan decision will be sent to you, confirming if you’re eligible for a loan or not. All of these will happen in less than 10 min.

After your loan decision has been sent to you, you can go ahead and apply for your first loan.

PLEASE NOTE: The faster you are in repaying your loans, the higher the subsequent loan amounts that will be granted to you. So do well to repay your loans in the quickest time possible.

2. FairMoney

Download now: Fairmoney Loan app.

The reason why I can confidently recommend the FairMoney loan app to anyone is due to the fact that securing a loan with them is not only fast, but their interest rate is also among the lowest that you can find anywhere right now.

In addition to that, the I app’s interface is extremely easy to navigate and guess what, the moment you’re paying off your outstanding loan, the same moment you’ll be eligible to get a new one, except you defaulted on your last loan by paying late.

So in case, you’re looking for ways to get quick cash loans at fair interest rates (pun intended) without collateral here in Nigeria, then this is undoubtedly one of the best loan apps you can find around.

3. Branch

Download now: Branch loan app.

If there is one app here that I can say matches the authenticity of the Carbon(PayLater) loan app, then it’s definitely the Branch app.

The main reason why I like the Branch loan app is simply for the longer durations they give before expecting you to repay your loans.

While other lenders will give you a maximum of 1 – 2 weeks for the first loan on their platform, Branch actually gives you a complete month before you start thinking of repaying your first loan.

Although a lot of you might find their interest rate to be a little bit on the high side, especially when you’re taking larger loans, say from ₦15,000 and upwards, it still doesn’t dispute the fact that they easily and effortlessly fall among the best loan apps that you can get in Nigeria today.

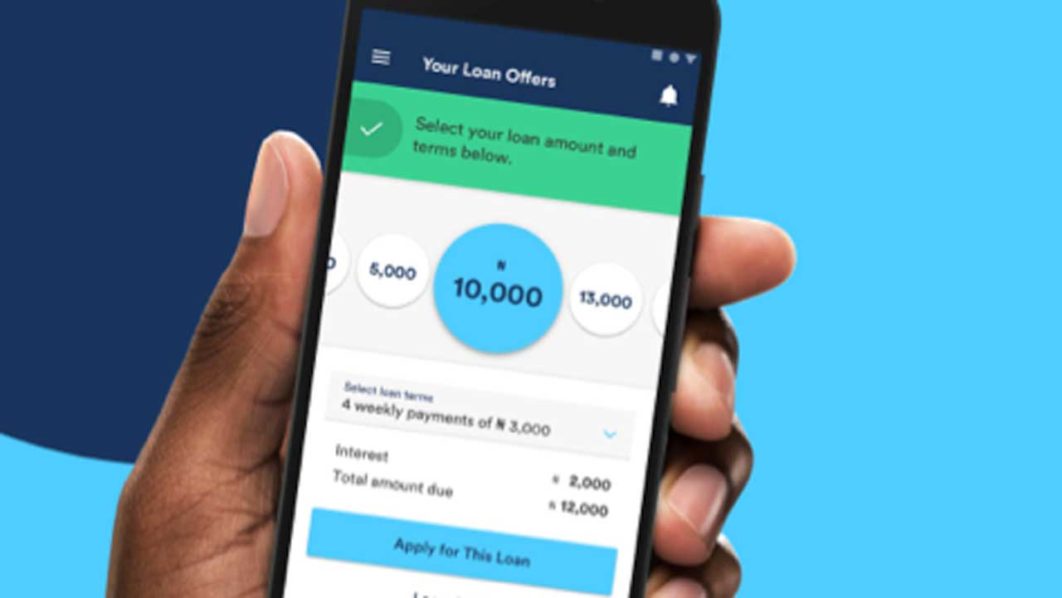

4. QuickCheck

Download now: QuickCheck loan app.

If you’ve been constantly searching for the best loan apps in Nigeria and haven’t come across QuickCheck, then you haven’t searched well enough.

Some of the things I love QuickCheck for, and that which will make me be quick to recommend it to anyone, is the fact that, first, they’re super quick to grant you a loan just as their name implies, and second, they give flexible loan repayment options.

Like you get to choose when it’s more suitable for you to repay your loan, between 7 days, two weeks, a month, or even more than that, depending on the amount of loan you’re collecting.

Now the sweet spot here is, no matter what time range you chose, the earlier you are in repaying the said loan, the higher the discount you get on the interest. So let’s say you took a loan of 5,000 NGN to pay back 6,000 NGN in two weeks.

If you can repay this said loan on time, way earlier before the due date, you might end up paying 5,500 NGN or even less than that, depending on how early enough you are in repaying it.

And one more thing is, the app interface is super user-friendly and easy to use, with all these added makes it easily one of the best loan apps available in Nigeria, period.

5. OKash

Download now: Okash loan app.

Okash came into the online loan business in late 2019, and since then, they’ve managed to gather up to one million borrowers on the platform, and a positive star rating of 4.4 out of 5 on the Google Play store.

A couple of things I like about them are;

First, they don’t require your BVN when setting up an account with them, and second is, unlike other loan apps out there that offer you a very little amount on your first loan application, Okash starts with a minimum of 3,000 NGN or even more, depending on the data provided.

Now, for one thing, Okash easily falls among some of the best loan apps you can find around, but at the same time, they can easily turn out to be the worse, even faster than you can imagine, and this only happens when you fail to repay your loan on time.

Okash will waste no time in calling your phone every now and then, requesting their money, sometimes even issuing threats, and they can even go as far as sending text messages to your contacts, telling them you borrowed some money using their platform, and has refused to pay back.

Now that doesn’t sound good, does it?

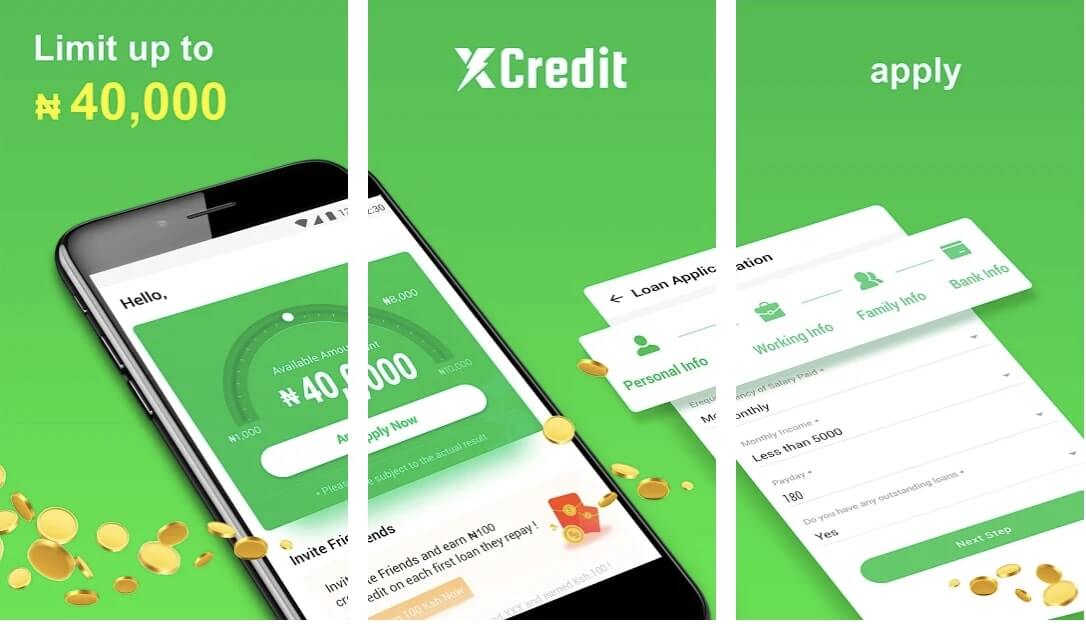

6. XCredit

Download now: XCredit loan app.

XCredit might not sound so popular to lots of people out there, but it easily falls among the best loan apps in Nigeria, and one that I have actually tried myself.

The only issue with them is the fact that the app interface might not really be as friendly and professional-looking as the other ones we have spoken about, but it actually works.

And one more thing you have to note and be very mindful of is that XCredit will happily keep adding a 1% late repayment fee to your loan for every day that you’re late on repaying your last loan.

So for instance, let’s say you took a loan of ₦5,000 to repay ₦6,500 in 10 days. If for any reason you weren’t able to meet up with repaying the loan on the due date, XCredit will keep adding ₦65 to your debt every single day until you’re able to repay the said loan.

So depending on how long it takes you, you might end up paying back ₦7,000 – 8,000 for a loan of ₦5,000 that you collected, and also get ready to be bombarded with calls and even threatening text messages, just like Okash.

So in this case, I’ll advise that you thread and think carefully before securing a loan with them, and you should only do so when you have a sure means of paying back the money before or on the due date.

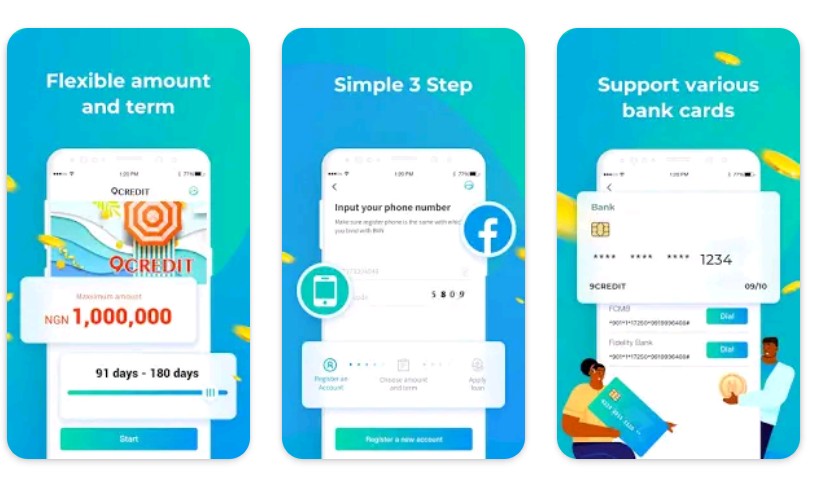

7. 9Credit

Download now: 9Credit loan app.

Same as XCredit, 9Credit might not sound so known to a lot of people out there, but it actually works, and for some, might easily fall among the best loan apps in Nigeria.

The app interface might not look all that welcoming, friendly, or professional, and as if that isn’t enough headache to deal with already, the amount of time given for you to repay your loans is way shorter when compared to other lenders.

Imagine giving someone just 7 days to repay back a loan of ₦15,000, I mean that’s not fair, to be honest. If one can make ₦15,000 in seven days, then what’s the need for taking a loan in the first place?

So once again and just as I warned against Okash and XCredit, you should think carefully before securing a loan from these guys, and you should only do so when you’re totally out of options, else, I’ll advise that you stick with the first four apps I already listed and discussed above, which are; Carbon, Fairmoney, Branch, and Quickcheck.

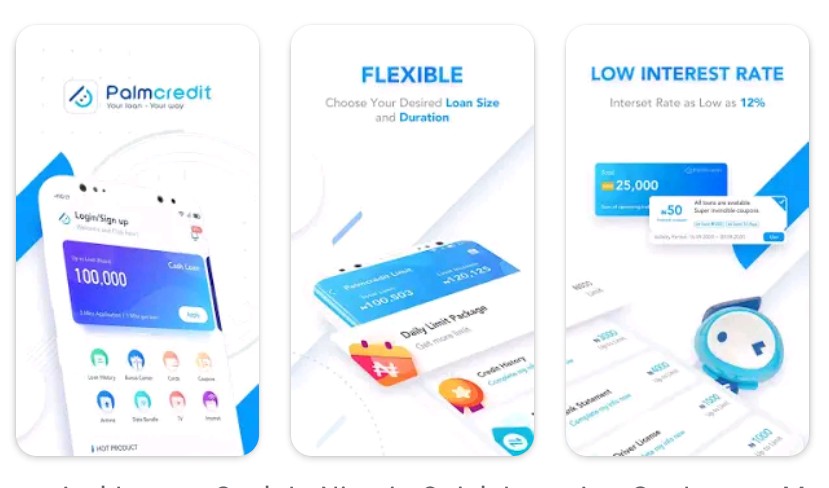

8. PalmCredit

Download now: Palmcredit loan app.

Though I haven’t used the Palmcredit loan app, simply because they refused to grant me a loan for some reasons best known to them, but from the number of positive reviews and the number of downloads they’ve managed to attain so far on Google Play Store, then I have no reasons to doubt the authenticity of the app.

So to the one reading this, you can simply download the app from the link given above, when you’ve done so, applying for a loan on the platform is pretty straightforward and easy, with you giving them all the details about you that they will request.

After that, a loan decision will be made on your behalf and you’ll be notified if you’re eligible to secure a loan with them or not. That’s it.

So go ahead and give them a try.

9. Sokoloan

Download Now: Sokoloan loan app.

Sokoloan is another loaning platform or app that I haven’t given a try myself, but I trust that they should fall among some of the best loan apps in Nigeria, especially when they have up to a 4.8-star rating out of 5, and over 1 million+ download on the Play store.

So just as you did for Palmcredit, you can quickly head over to the Play store to download the app, so you can have a first-hand experience with them.

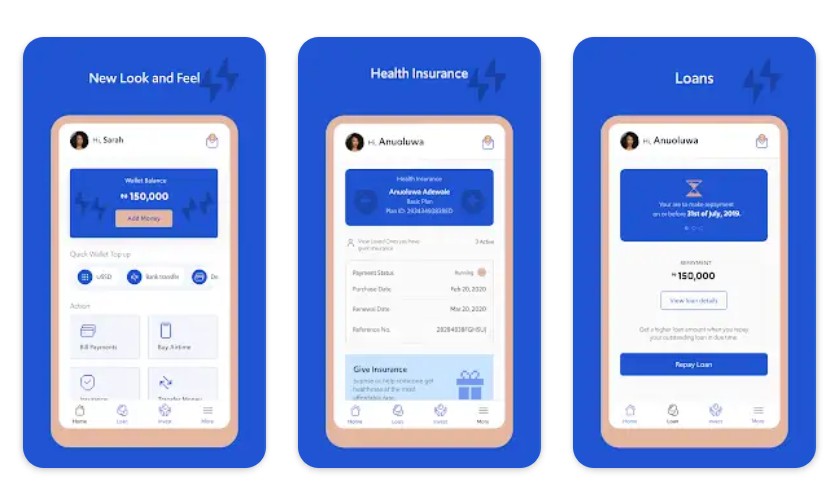

10. Aella App (formerly Aella Credit)

Download now: Aella app loan app.

Aella app is more of a daily transaction app than it is a loan app, but you can still secure a loan with them if you wanted to, though, for some reason best loan to them, they also turned down my loan request, so I wouldn’t really say that I’ve had a first-person experience with them.

Among all the apps listed here, they actually have the least number of downloads and the lowest rating as well, but that doesn’t dispute the fact that you can give them a shot by downloading the app from the link given above, and see how things go with them.

One reason why I recommend them so much is the fact that, unlike other loan apps that charge you a non-refundable fee in order to link your card to the platform before letting you know if you’re eligible for a loan or not, the Aella app first lets you know if you’re eligible for a loan, before asking you to link your card.

And that wraps it up for the best loan apps in Nigeria that you can find right now.

If you have any questions, please leave them in the comments section below, and if you find this post helpful, then kindly give it a thumbs up by sharing it, and as always, I’ll see y’all tomorrow, #peace out.

Read also